Investing in the stock market is a key part of building wealth nowadays. It doesn’t matter if you’re just starting or have been at it for years. Knowing the basics of investing is very important.

This article will give you useful tips and insights. They’ll help you understand the ups and downs of the stock market in the US. By understanding these concepts, you can make smart choices and aim for your financial dreams.

Anúncios

Understanding the Basics of Stock Market Investing

The stock market is where people buy and sell shares of public companies. Knowing how it works helps investors make smart choices. Investing in stocks offers a chance for profits and is key for building wealth over time.

What is the Stock Market?

It is made up of exchanges where company stocks are bought and sold. Companies raise money here, and investors can become part-owners. Buying shares means you’re betting on the company’s success and hoping its value goes up.

Importance of Stock Market in Wealth Building

Investing in stocks can really boost your finances. It’s a way to grow wealth faster than traditional saving. Besides money, the stock market teaches about investing and how the economic world functions.

Setting Clear Investment Goals

Creating clear investment goals helps shape your stock market strategy and decisions. It’s key to know the difference between short-term and long-term goals. This knowledge lets investors align their financial plans with their dreams.

Defining Short-Term and Long-Term Goals

Short-term goals are about meeting immediate financial needs, such as:

- Funding vacations or travel

- Saving for a new vehicle

- Purchasing a home

Long-term goals aim at bigger financial dreams, including:

- Planning for retirement

- Saving for children’s education

- Building a substantial investment portfolio

Knowing if a goal is short-term or long-term helps in prioritizing and planning better.

Tips for Goal Setting

Use these tips to make sure your investment goals are strategic and practical:

- Be Specific: Clearly state your goals and their timeframe.

- Assess Your Financial Situation: Know how much you can invest.

- Set Realistic Timelines: Choose achievable deadlines for your goals.

- Prioritize Your Goals: Order your goals by urgency and importance.

With focus on these goals, investors can make smart choices and stick to their plans.

Determining Your Financial Capacity

Understanding how much money you can spend is key before starting in the stock market. It’s important to look at your income and what you spend money on. By setting a budget, you can figure out how much money you can put into stocks without hurting your financial health.

Assessing Income and Expenses

Looking closely at how much money you make and your monthly bills is crucial. Here’s how to do it:

- List everything that brings you money, like your paycheck, any bonuses, and passive income.

- Write down your monthly bills, splitting them into fixed and changing costs.

- Think about your optional spending to see where you might save money.

This review helps show how much you can invest after taking care of your needs.

Establishing an Emergency Fund

Creating a safety net of savings is vital. This fund should cover living costs for three to six months. It keeps your investments safe and gives you comfort if money gets tight. Here’s how to start:

- Figure out your monthly expenses to know how big this fund needs to be.

- Pick a saving goal based on what you can afford.

- Make saving automatic to grow this fund without thinking about it.

Evaluating Risk Tolerance and Investment Style

It’s key to know how much risk you’re okay with when investing. This idea talks about how much risk you’re ready to take for possible gains. Knowing what risks you’re comfortable with helps plan your investment strategy. This plan should match your money goals and how much risk feels right.

Understanding Risk vs. Return

In investing, risk and return go hand in hand. Usually, the chance for higher returns means a higher risk. It’s important to balance your risk comfort with the rewards you aim for. People who want stability might pick safer investments, like bonds or dividend stocks. These usually have lower returns but less risk.

On the other hand, bold investors might choose growth stocks. These can offer big returns but come with more risk.

Identifying Your Comfort Level with Volatility

Market swings can make many investors nervous. Knowing how much market ups and downs you can handle helps you make better choices. If you prefer stability, look for investments with less price change. But if you’re okay with some market rollercoasters, you might go for riskier options.

Being clear on your risk tolerance makes for smarter, less emotional choices. This leads to a more steady investment method.

Choosing the Right Investment Account

Choosing the right investment account is key for your investment strategy. Each account type affects your financial goals and taxes differently. By knowing the options, you can pick one that fits your needs.

Types of Investment Accounts

There are different investment account types available, each with its unique purpose:

- Brokerage Accounts: These accounts are flexible, letting you buy and sell various investments like stocks and bonds.

- Retirement Accounts: These include IRAs and 401(k)s, offering tax benefits to save for the future.

- Managed Accounts: If you want experts to handle your investments, these accounts are for you.

Tax Implications of Different Accounts

It’s important to think about taxes when picking an investment account. For example:

- Putting money into traditional retirement accounts could lower your taxes now, but you’ll pay taxes when you withdraw in retirement.

- Brokerage accounts might lead to taxes on the money you make each year, affecting your returns.

- Roth IRAs are great for those who want to avoid taxes on money taken out in retirement.

How to Fund Your Stock Account

After picking a broker and starting to set up your account, funding it is the next big step. You can use bank transfers or check deposits to add money. Knowing the details of each method can make your investing smoother.

Bank Transfers vs. Check Deposits

Bank transfers are quick and convenient for putting money into your stock account. They let you access your investments fast and avoid check processing waits. Check deposits, however, might slow you down because they take longer to clear.

- Bank transfers ensure funds are available almost immediately.

- Check deposits can require several business days for processing.

Your choice depends on how fast you want to access your funds for investing.

Setting Up Automatic Contributions

Automatic contributions make funding easy and encourage a steady investment approach. Setting up regular payments to your stock account helps you buy stocks over time. This can level out market ups and downs.

Here are benefits of automatic contributions:

- Consistent investment schedule promotes financial discipline.

- Reduces the emotional influence of market fluctuations on investment decisions.

Using bank transfers for automatic payments keeps your stock account ready for action.

Strategies for Selecting Stock Investments

Choosing stocks wisely needs looking at many things. This includes deep research on market trends and how companies are doing. Knowing how the market works helps investors pick stocks that meet their financial goals.

Researching Stocks and Market Trends

Before putting money in, it’s key to look at market trends to find good chances. Investors should:

- Look at past data to see patterns and changes in how stocks perform.

- Stay up-to-date with news that could affect certain areas or the whole market.

- Use financial news sites and tools for stock analysis to get valuable insights.

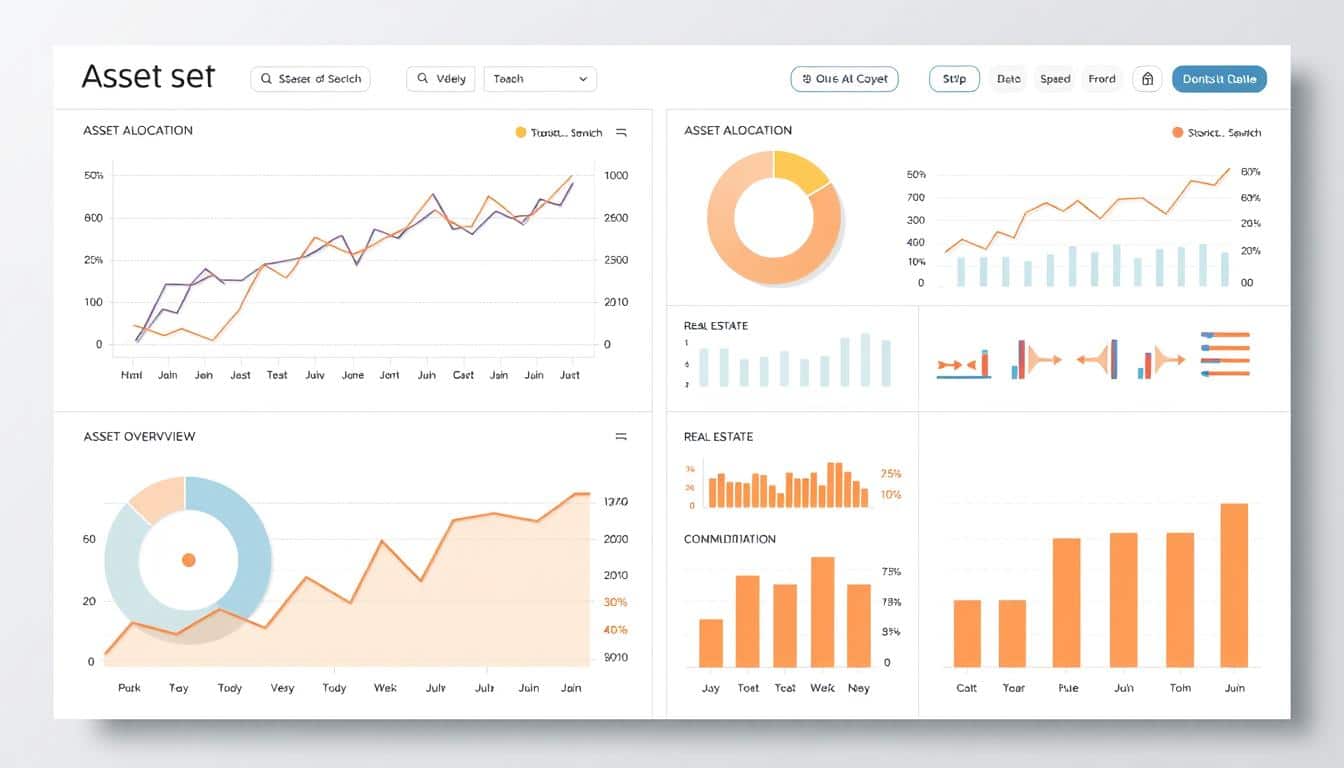

Diversification and Asset Allocation Techniques

Using diversification can greatly reduce risk in investing. Investors should spread their money across different types of assets, like:

- Stocks from various industries.

- Bonds for consistent income.

- Real estate or commodities to protect against inflation.

Having the right mix of assets is key for long-term success and growth. Smartly dividing funds among these different areas helps safeguard portfolios against ups and downs in the market. It also sets them up for steady growth.

Navigating Market Volatility

Market volatility is a normal part of investing in stocks. It causes price changes that can worry even experienced investors. Knowing about market cycles helps understand these changes. This understanding lets investors stay steady. It helps them avoid quick decisions that hurt their long-term financial plans.

Understanding Market Cycles

Market cycles have times of growth and shrinkage. It’s important for investors to know these cycles. They play a big role in market volatility. These cycles include:

- Recovery: Markets stabilize after a fall, raising investor confidence.

- Expansion: Prices and economic activity increase, offering more chances to invest.

- Recession: When economic activity decreases, markets become more volatile as prices drop.

- Trough: The lowest point before things start to improve, which is a chance to buy undervalued assets.

Staying Calm During Market Fluctuations

It’s easy to let emotions guide you during market ups and downs. Staying calm means planning ahead and sticking to your investment goals. Here are ways to keep your cool:

- Review your investment plan often: It should match your long-term aims and how much risk you can take.

- Keep your investments varied: This lowers risk and helps keep your investments stable.

- Don’t make quick, unplanned decisions: Stay calm during low times.

- Keep learning: Understanding market cycles and trends helps you make smarter choices.

Conclusion

Understanding the stock market is both complex and fascinating. It combines knowing investment basics with managing your own money. To do well, you need to set clear goals that match your money plans. Whether you’re aiming for quick wins or long-term growth influences your investment path.

Picking the right investment accounts matters a lot, especially when thinking about taxes. These choices can shape your investment plan and boost your money’s growth. Also, being aware of how much risk you can handle helps during unpredictable times. It keeps your money safer.

To succeed, use strategies based on solid research, keep an eye on market trends, and stay disciplined with your investments. Following these steps can help you grow your wealth. Plus, it sets the foundation for lasting financial safety in your investment journey.

FAQ

What is stock investing?

How can I define my investment goals?

What should I include in my financial budget for investing?

What is risk tolerance, and why is it important?

What types of investment accounts should I consider?

What are the advantages of setting up automatic contributions to my investment account?

How can I effectively research stocks?

How do I handle market volatility?

Content created with the help of Artificial Intelligence.