Planning well for retirement is key to having enough money later on. Many worry about paying for healthcare and not having enough to live on. A survey by RBC Wealth Management found that 75% of people can’t guess their future financial needs.

This shows how important it is to have a specific plan for retirement. By using smart investment strategies and writing down a solid plan, you can secure your finances. This way, you’ll be better off in your later years.

Anúncios

Understanding Your Retirement Needs

Figuring out what you need for retirement is key to feeling secure later on. You start this by looking closely at your money situation now. This means checking your everyday costs, along with the extra things you might want to do.

Evaluating Your Current Financial Situation

To know what you’ll need later, first understand what you have now. Add up what you own and what you owe. This gives you a clear picture of where you stand financially. Then, see where your money is going each month. Knowing this is important for planning a retirement budget that covers needs and some wants.

Identifying Essential and Non-Essential Expenses

It’s important to know what you must have for a good life in retirement. This includes costs like your home, health care, and daily expenses. Make a list of these essentials because they’ll be a big part of your budget. Then, think about the extra things, like trips or hobbies. These can change based on what you want or aim for. Finding a good mix of these costs lets you plan better for retirement.

The Importance of Creating a Personalized Plan

It’s crucial to have a personalized retirement plan to secure your finances for the future. This plan focuses on your unique needs and goals. Knowing you have financial security brings great peace of mind.

Why a Customized Retirement Plan is Crucial

Having a plan tailored to your retirement needs is key to getting the most out of your savings. Experts say a clear plan can lessen worries about money. A study by RBC Wealth Management found people with specific plans felt more at ease in retirement. This shows how important a well-thought-out strategy is.

Retirement Planning: Key Steps to Take

Effective retirement planning involves a few key steps. Setting clear goals for your retirement is important. It helps blend what you need financially with what you want to do. This requires careful thinking about your goals for this part of your life.

Setting Clear Retirement Goals

When identifying retirement goals, think about what you truly want. This includes where you want to travel, lifestyle changes, or new hobbies. By setting specific and measurable goals, you make your financial planning easier. It helps you decide where to use your resources and time best.

Creating a Budget for Retirement

Budgeting is very important for a secure financial future. A good budget helps keep track of spending and avoids waste. Start by guessing your income needs and consider how your lifestyle might change. Don’t forget about extra costs, like healthcare, that come with getting older. It’s good to review your budget often to make sure it fits your goals for retirement.

Income Sources in Retirement

Finding dependable sources of income for retirement is key to a stable future. Social Security is often a major source for retirees. It’s crucial to understand how to get the most out of this benefit. Pensions and annuities are also key for providing income during retirement.

Understanding Social Security Benefits

Social Security benefits help those who’ve paid into the system while working. You can start getting benefits as early as age 62. But waiting to claim can increase your monthly amount. Making the right choice on when to claim is important to make the most of this income.

Exploring Pensions, Annuities, and Other Income Streams

Pensions are another key income source for retirees, based on work history and earnings. Annuities are agreements with insurance companies for future income. Investments and other incomes can also add to your retirement funds. Planning with all income sources in mind helps you maximize your money in retirement.

Health Savings Accounts (HSAs) and Retirement

Health Savings Accounts offer a smart way to save for medical costs in retirement. They give strong tax perks, helping you now and later. HSAs are key for managing healthcare expenses after you retire.

Maximizing the Benefits of HSAs

To make the most of HSAs, aim to put in as much money as allowed. You put in money before taxes, which saves you money right away. Taking money out for health needs is also tax-free. After you turn 65, you can use the money for anything without losing money to penalties.

As you get older, think about these important steps:

- Put the maximum amount into your HSA each year to have enough for future medical costs.

- Try to cover current health bills yourself, so your HSA money can grow without taxes.

- Save receipts for all health costs. You can get paid back from your HSA at any time.

Following these tips will help you make the most of your Health Savings Account. This way, you’ll be ready for the high costs of healthcare when you retire.

Managing Your Investments for Retirement

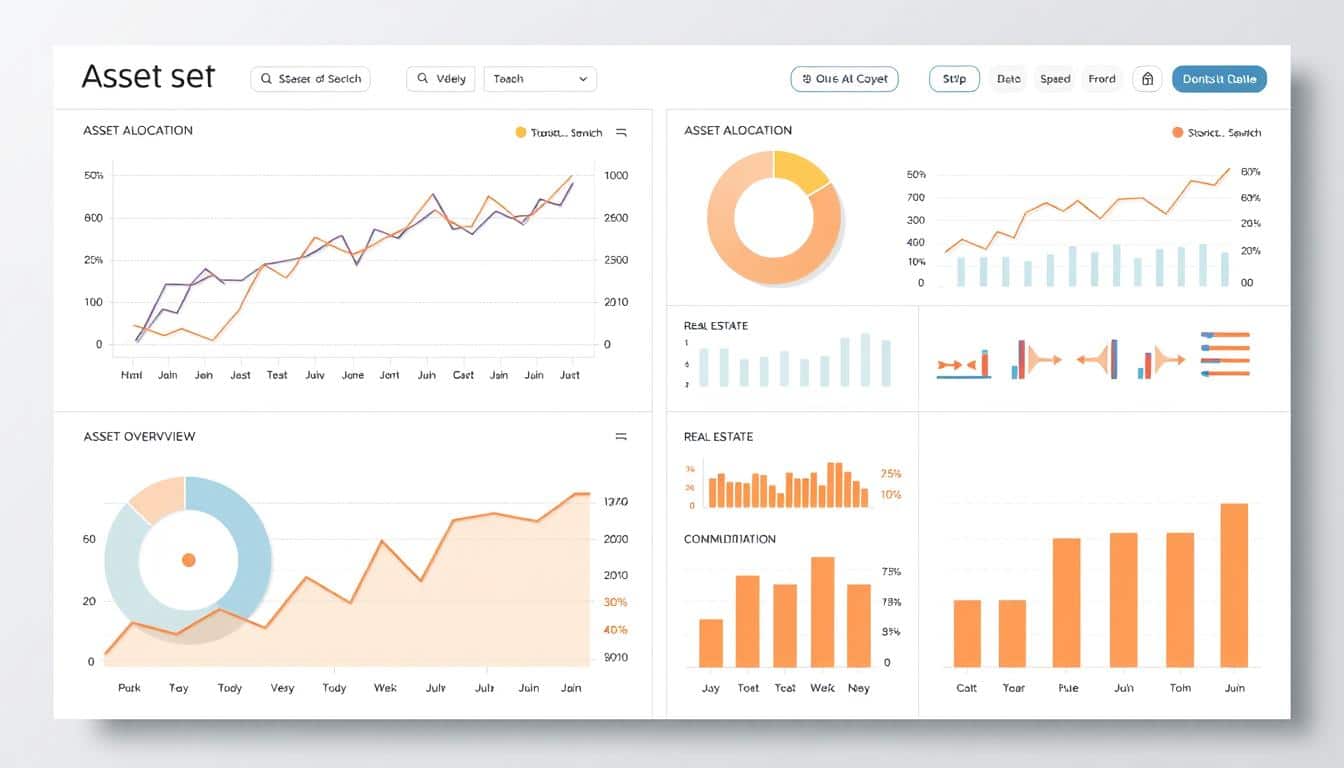

Managing your money for retirement is key to a secure future. It’s important to mix different types of assets in your retirement savings. Doing so helps you handle ups and downs in the market.

Diversifying Your Investment Portfolio

Putting your money in a variety of assets is what diversification means. You might invest in:

- Stocks, which can grow in value but are risky

- Bonds, which are more stable and provide income

- Real estate, for income and potential increase in value

- Cash equivalents, for quick access to money when needed

This strategy helps protect your savings when the market is tough. Different investments react differently to economic changes.

Strategies for Drawing Down Investments

Choosing the right way to use your retirement savings is crucial. Using a smart plan for taking money out can help your savings last longer. Some popular approaches are:

- Start with taxable accounts to save on taxes

- Then use tax-deferred accounts to keep the tax benefits going

- Use tax-free accounts last, like Roth IRAs, for ongoing growth

These methods help make sure you have money throughout retirement. This can give you a sense of security in your later years.

Addressing Debt Before Retirement

Getting debt under control before retiring is key for a relaxed financial life later. It helps lessen stress in retirement, making space for living costs instead of just interest payments. Making debt repayment a priority is essential for a worry-free retirement time.

Strategies to Pay Off High-Interest Debt

Planning and discipline are vital for reducing high-interest debt. Here’s what you can do:

- Start by paying off the debts with the highest interest rates. This reduces the total interest you pay and frees you from debt faster.

- Make a budget to keep an eye on your monthly spending and find where you can spend less. This extra money can go towards lowering your debt.

- Look into consolidating your debt to get a lower interest rate. This can make your payments simpler and possibly reduce what you owe in total.

- Try to use cash when buying things to stop more debt from piling up. A cash-only approach for big purchases can keep your spending in check.

- Automate your debt payments to make sure they’re always on time. This avoids late fees.

By following these steps, you can plan better for your finances and head into retirement with less debt.

The Role of Tax Planning in Retirement

Tax planning is crucial for a solid retirement plan. It involves understanding how different taxes affect your retirement funds. By using tax diversification, you can better manage your money.

This method helps you handle your expenses smartly during retirement.

Tax Diversification of Retirement Accounts

Diversification is not just for investments. It also matters for the tax status of your accounts. Mixing tax-deferred, taxable, and tax-exempt accounts gives you more control.

This flexibility helps you deal with changing tax situations and personal finances smoothly.

Understanding Withdrawal Strategies for Tax Efficiency

Planning how you withdraw money in retirement is key. Taking money out in a smart way can lower your taxes over time. For example, Roth conversions in low-income years might save more money on taxes.

This strategy helps keep more cash in your pocket and reduces tax stress.

Legacy Planning and Estate Considerations

Planning your legacy is an essential part of getting ready for the future. It’s not something to overlook when you’re planning for retirement. This step means you decide who gets what after you pass away. Besides picking who inherits, think about supporting education and charities that match your beliefs. Estate planning helps reduce estate taxes. That way, your loved ones or chosen organizations get more from what you leave behind.

Defining Your Legacy Goals

Setting your legacy goals involves a few key actions:

- Choose people or groups you want to support.

- Pick the specific things you want to give and why.

- Think about how your choices will affect your family and charities in the long run.

Understanding Estate Taxes and Gifting Strategies

Estate taxes can greatly reduce what you leave behind. Knowing the tax rules is crucial for smart planning. Giving gifts while you’re alive can lessen tax impacts. Some ways to do this include:

- Using the annual gift tax break to give money without taxes.

- Naming people to directly receive your retirement funds or insurance, avoiding estate taxes.

- Setting up trusts to control and safeguard your assets as you wish.

Conclusion

Planning for retirement is really important for long-term financial safety. A full plan helps you smoothly go through your retirement years. It also helps you deal with surprises that might come up. Making a plan that’s just for you lets you focus on your own needs and dreams.

This article showed that things like where your money comes from, health care costs, and your legacy are key to a good retirement plan. Keeping your plan updated makes sure it fits your life and any economic changes. This leads to a safer and happier retirement.

Your step into retirement should match your money goals and how you want to live. A good retirement plan lets you enjoy your older years without worrying about money.

FAQ

What are the main concerns people have about retirement planning?

Why is a personalized retirement plan essential?

What expenses should I prioritize in my retirement budget?

How can I maximize my Social Security benefits?

What advantages do Health Savings Accounts (HSAs) offer for retirement planning?

What strategies should I consider for managing my investment portfolio during retirement?

How can I address debt before retiring?

What role does tax planning play in retirement?

What should I consider when planning my legacy and estate distribution?

Content created with the help of Artificial Intelligence.